Due to the current Corona Virus Disease 2019 (COVID19) pandemic, our Federal Government has had to make adjustments to compensate for both the health and economic impacts of COVID-19. A major economic adjustment isthe due date for filing 2019 taxes changed from April 2020 to July 15, 2020.

Due to the current Corona Virus Disease 2019 (COVID19) pandemic, our Federal Government has had to make adjustments to compensate for both the health and economic impacts of COVID-19. A major economic adjustment isthe due date for filing 2019 taxes changed from April 2020 to July 15, 2020.

CCY is urging youth who are eligible to file their taxes and for service providers and youth allies to assist youth in filing. The following is a quick guide about taxes for youth and youth filers.

Net Income vs. Gross Income

Income should just be income, right? If you worked at a grocery store for $11.00/hour, you worked 27 hours this pay period, so you might be expecting to get a paycheck for $297. Instead your take-home pay is closer to $250. Why is that?

Every person who earns money working in the U.S. is supposed to pay federal income tax – which includes you! You’re also required to contribute to Social Security and FICA. Most states governments charge a state income tax, too. Since the government expects you to pay taxes, they make it easy for you by taking it directly out of your wages.

So what is gross income and net income? Your gross income is the amount of salary or wages your employer paid you before any tax was taken. So, the $297 you earned for 27 hours of work is your gross income. But your net income is what you take home after you have paid income tax, Social Security, and FICA.

Tax Filing Status

Unless you’re married, the filing status on your tax return should be single. The IRS cares about your filing status because it helps them understand which income tax bracket to put you in. Single people, married couples, people with dependents, and widow(er)s are put into different tax brackets, based on their filing status.

Income Tax Brackets

How do you know how much you owe for taxes? There’s some math involved. The amount of tax you pay is a percent of your total taxable income for the year. This is called your tax rate.

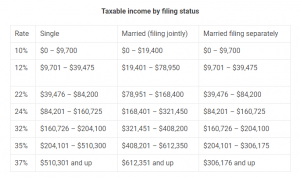

The government decides how much tax you owe by dividing your taxable income into chunks – also known as tax brackets. Each chunk gets taxed at a different rate. For example, here is a look at the tax brackets for 2019:

The rate you pay on your chunks depends on what your filing status is.

Who is Required to File a Tax Return?

Not everyone has to file taxes. For example, if your filing status is single and you earn less than $12,200 per year from your job, you don’t have to file a tax return.

Why Should Youth File their own taxes?

If your employer withheld money from your paycheck for taxes (and they probably did), you might be owed a refund. But, you can’t get your refund if you don’t file a tax return.

The info you enter on your tax return will be used to calculate whether your employer withheld too much, too little, or just enough from your paycheck to cover the taxes you owe. If too much was withheld, you will receive a refund.

“Do I have to pay taxes for a side job like babysitting, lawn mowing, etc.?”

Maybe. If you earn more than $400 by mowing lawns or babysitting (or something similar), th eIRS considers you self-employed – no matter how old you are. So, you’ll need to file a tax return and report what you earned from these types of jobs if you earn more than $400 per year.

The good news is, you can also take tax deductions for certain expenses that are related to your job. For example, you could deduct mileage if you drive yourself to work. And if you use your own lawnmower to mow grass, you could write off the cost of your equipment.

What you need to file a simple tax return

There are a few things you’ll need to have ready to file a simple tax return.

- Your W-2. Your employer should send your IRS Form W-2 Wage and Tax Statement in the mail or by email in January.

- Your Legal Name.

- Your Tax-ID number. This will most likely be your Social Security Number (SSN). If you don’t know your number, you can find it on your Social Security Card. If you don’t have a SSN you will need an ITIN. The IRS uses this to make sure you are who you say you are.

Source: Taxslayer.com

Additional resources: